Average and Minimum Salaries in the Czech Republic

The labor market in the Czech Republic attracts foreign specialists. Migrants come to the Czech Republic because they know: the unemployment rate here is low, and salaries are decent. In this article, we will discuss the average salary in the Czech Republic, which industries pay the most, and what percentage of income needs to be allocated to the budget as taxes.

Employment Features in the Czech Republic

There are three types of employment contracts in the Czech Republic: permanent, seasonal, and temporary. A permanent contract is the same as an indefinite contract. It is signed for an indefinite period, granting employees the right to paid leave and sick days. The contract can be terminated at the employee’s request, by mutual agreement, due to staff reductions, or as a result of dismissal.

Seasonal and temporary contracts provide fewer guarantees. These agreements are signed for a fixed term, after which the employer may choose not to renew the contract without explanation.

Salary by Industry

When it comes to highly skilled jobs, the highest salaries are earned by doctors, engineers, and IT specialists. For medium- and low-skilled workers, the most in-demand professions in the Czech labor market include farmers, construction workers, service industry employees, salespeople, taxi drivers, and truck drivers. The average salary in the Czech Republic is the same for both locals and migrants—employers do not differentiate between employees.

According to the Statistical Office, in 2024, the average salary in the Czech Republic amounted to 45,400 CZK. Below is a breakdown by industry:

| Industry | Average Salary (CZK, Q3 2024) |

|---|---|

| Agriculture, Forestry, and Fishing | 34,400 |

| Mining | 45,000 |

| Manufacturing | 44,200 |

| Energy | 71,200 |

| Construction | 38,600 |

| Transportation and Storage | 41,100 |

| Catering, Hospitality, and Public Food Services | 27,000 |

The highest average salary is in Prague, where it reaches 55,800 CZK. Below is a comparison of average salaries in other regions of the country:

| Region | Average Salary (CZK) |

|---|---|

| Central Bohemia | 45,600 |

| South Bohemia | 41,600 |

| Karlovy Vary | 39,200 |

| South Moravia | 44,800 |

| Olomouc | 41,300 |

Statistics show that men in the Czech Republic earn more than women. As of May 2024, the average salary in the Czech Republic in euros was €1,700 per month for men and €1,500 per month for women. This difference is due to the fact that men are more commonly employed in high-paying industries such as construction, manufacturing, and industrial production. The more experience an employee has, the higher salary they can expect. Beginners and interns usually receive the minimum wage. However, migrants have the same career growth opportunities as locals. To advance faster, professionals not only need strong skills but also knowledge of the Czech language. While English may be sufficient for entry-level jobs, experienced specialists prefer to communicate in Czech.

Minimum Salary in the Czech Republic

The minimum salary in the Czech Republic in 2025 is €825.89 per month. In the fourth quarter of 2024, this figure was €755.24. However, an employee may earn less if they work part-time or have a reduced workweek. This means that the level of income directly depends on the nature of employment. For this reason, many employers calculate wages based on an hourly rate. In 2025, the hourly rate is €4.9.

To find real figures for minimum and maximum salaries, one can visit any job search website and apply the necessary filters. For example, on one of the Czech job sites, it is stated that a sales assistant or cashier in Prague can expect a salary of 23,500 CZK (a little over €930 per month). This assumes official full-time employment. The requirements for candidates are minimal: secondary or vocational education.

A minimum salary is also offered for the positions of a baggage handler at the airport (32,500 CZK per month), general laborer (33,500 CZK per month), and delivery driver (from 33,000 CZK per month).

Income Taxes

All residents are required to pay income tax to the state budget. A resident is a person who has been in the country for at least 183 days in a calendar year. Non-residents must also pay income tax in the Czech Republic on earnings received within the country.

The Czech Republic has two income tax rates: 15% and 23%. In most cases, the basic rate of 15% applies. However, if a taxpayer’s income exceeds 48 times the average salary, they must pay income tax at the higher rate of 23%. Special online calculators can be used in advance to estimate the tax amount and calculate social security contributions. Additionally, a portion of the salary is deducted for social security and health insurance in case of loss of work ability.

If a resident works for one company under an employment contract, the employer submits the tax return on behalf of the employee. However, if a person works for multiple employers and income is not recorded everywhere, the employee must file their own tax return to avoid penalties for undeclared income. The return can be submitted in person on paper or sent electronically. A certificate of income issued by the employer must be attached to the document. In 2025, the deadlines for filing tax returns are:

- Paper form — by April 1, 2025

- Digital form — by May 2, 2025

Employees may face difficulties in completing the tax return, often due to language barriers. In such cases, special agencies offer assistance for a fee, helping with document preparation and advising on available tax deductions.

If an employee received expensive gifts during the tax period, their value must also be included in the declaration as income. The only exception is gifts from close family members (spouse, parents, children).

Tax Deductions

Residents have the right to reduce their taxable base through social and property-related deductions. The government is willing to refund part of the money spent on:

- Mortgage interest payments

- Voluntary pension contributions

- Charitable donations

- Kindergarten fees for children

Tax benefits are also provided to blood and plasma donors. For each blood donation, 3,000 CZK can be deducted from the taxable base. For bone marrow donation, the base is reduced by 20,000 CZK. Additionally, there are tax deductions for children and spouses who live with the taxpayer.

Penalties for Illegal Employment

If it is discovered that a migrant is working illegally in the Czech Republic, they may face a fine of up to 100,000 CZK. However, financial penalties are not the only consequence. The worker may also be blacklisted and banned from entering the country for up to 10 years.

Employers are also held accountable for such violations. If a company hires an employee illegally, it may not only be fined up to 1 million CZK, but also risk losing its business license.

If an employer violates employee rights, workers can file a complaint with the State Labor Inspectorate in the Czech Republic.

How to Get a Job in the Czech Republic

Migrants who want to move to the Czech Republic and find employment should start by searching for job vacancies. Job websites list advertisements with job descriptions, salary details, and working conditions. If a job posting interests you, you can contact the employer directly using the contact information provided in the listing. The employer will review the application, conduct an interview, and decide whether the candidate is a good fit.

If the decision is positive, the company will arrange a work permit for the employee, allowing them to travel to the country and work legally. Once the permit is issued, the migrant must start the process of obtaining a work visa. The visa application must be submitted in person at the Czech consulate. Along with the employment contract and work permit, the following documents are required:

- Valid passport

- Two photographs

- Medical insurance

- Bank statement

In some cases, the consulate may also request a criminal record certificate and documents confirming family status (e.g., marriage certificate, proof of children).

If the consulate approves the visa, the migrant can move to the Czech Republic and work legally. Upon arrival, many apply for a residence permit. After five years of residence, migrants are eligible to apply for permanent residence. After another five years, foreign workers may qualify for Czech citizenship and obtain a Czech passport.

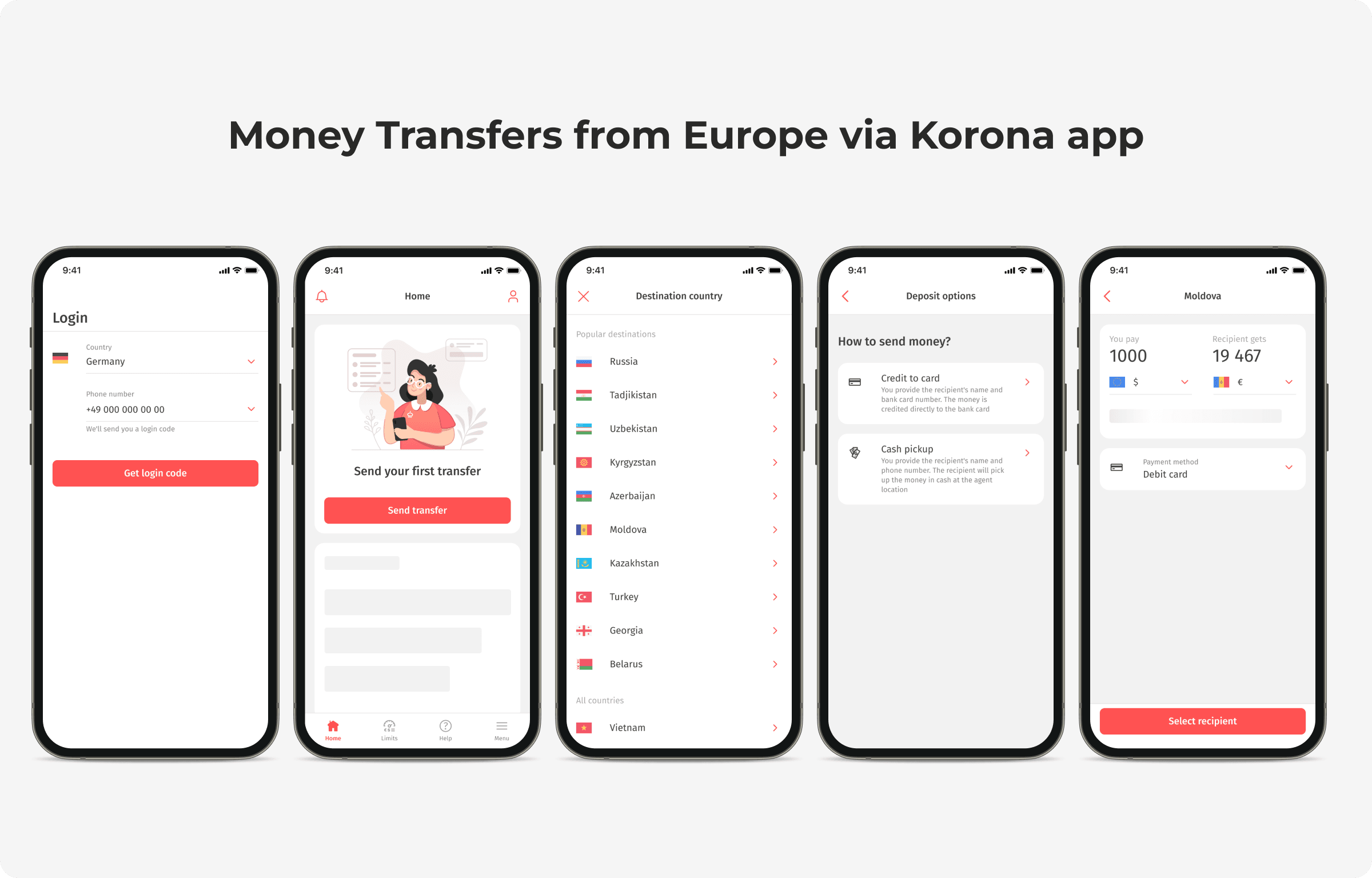

Money Transfers from Europe

Many migrants not only pay taxes on their income but also regularly send money back home to support their families. To save on transfer fees, they can use the Korona app. A money transfer request can be completed in just a few simple steps. The app is available for download on the App Store and Google Play.