Cost of Living in the United Kingdom

The United Kingdom is renowned for its prestigious educational institutions and a rapidly developing economy, offering promising career opportunities. However, moving to the UK comes with a number of financial challenges, particularly when it comes to building a family or personal budget.

At first glance, how much you will spend each month may seem like a question for the distant future, once you have already moved and settled in the country. However, this is not the case. By understanding in advance what budget you will need, you will be able to determine the salary required to live comfortably in the United Kingdom while also having the possibility to save or send money back home.

Average Cost of Living in the United Kingdom

In the UK, average monthly expenses vary depending on lifestyle, location, and individual circumstances. Nevertheless, the average cost of living index in the country is 2.09 times higher than the global average. It is one of the most expensive countries to live in, largely due to London, which frequently ranks among the top cities in terms of cost of living.

What is included in the cost of living calculations?

- Housing expenses: rent or mortgage, property tax;

- Utilities: electricity, gas, water, heating;

- Transportation: bus pass, gasoline, vehicle maintenance and insurance;

- Healthcare: health insurance, private clinic services, medications;

- Food expenses;

- Entertainment and leisure: restaurants, cinema, and other activities.

According to the website livingcost.org, the average cost of living in the UK is £17,989. The site also provides average figures for two categories: single households and families of four.

Please note: the website presents data in US dollars. For the sake of consistency in the information presented in this article, all currency conversions to pounds sterling will be made according to the exchange rate as of December 10, 2024.

Comparative Table of Cost of Living in the United Kingdom, £/month

| Indicator | Single Person | Family of 4 |

|---|---|---|

| Cost of living with rent | 1,799 | 4,346 |

| Cost of living without rent | 680 | 2,347 |

| Rent and utilities | 1,118 | 1,998 |

| Food | 419 | 1,084 |

| Transportation | 132 | 351 |

The figures in the table are approximate and do not take into account income levels, habits, location, and personal expenses.

According to Numbeo, 28.9% of a Briton’s monthly expenses go toward rent. 24.6% is spent on groceries, while another 17.9% is allocated for dining out. 11% of expenses go to transportation, and 7.5% is spent on utilities.

According to Statista, the average salary for full-time employees in the United Kingdom in 2024 was £37,430, which translates to £3,119 per month, compared to £34,963 in 2023.

Cost of Living Crisis

Rising prices, inflation, and the decline of “real” wages (purchasing power) are impacting residents of the United Kingdom. According to a survey commissioned by Ciphr and conducted by One Poll among 2,000 adults in the country in 2024:

- 54% experienced stress or depression due to rising prices;

- Every other respondent had to cut back on expenses, and one in eight was forced to downgrade when purchasing goods/services or to forgo several types of insurance, including dental, health, and car insurance;

- One in five faced difficulties in paying bills or buying food, while one in four ran out of funds before payday, benefits, or pensions;

- 20% requested a salary increase, one in six found a side job, and one in seven changed jobs for a higher-paying position;

- At the same time, 26% are still looking for a job that pays more than their current salary;

- One in seven had to take out a loan.

The rising cost of living leads people to work while sick to avoid losing benefits, and two out of five employees are taking on overtime.

Cost of Living in UK Cities

In almost every country, living costs are closely tied to specific locations, and the United Kingdom is no exception. Cities like London, Cambridge, and Oxford are expensive even for locals, let alone for students and seasonal workers. However, the standard of living in the UK is relatively high, regardless of which city you choose.

Average Cost of Living in the United Kingdom by Region, £

| Region | Single Person | Family (3-4 People) |

|---|---|---|

| London | £1,800–£2,300 | £3,500–£4,500 |

| South East England | £1,500–£2,000 | £3,000–£4,000 |

| South West England | £1,400–£1,900 | £2,800–£3,800 |

| East of England | £1,400–£1,900 | £2,800–£3,800 |

| West Midlands | £1,200–£1,700 | £2,500–£3,500 |

| North West England | £1,200–£1,700 | £2,500–£3,500 |

| Yorkshire and Humber | £1,100–£1,600 | £2,400–£3,400 |

| North East England | £1,000–£1,500 | £2,300–£3,300 |

| Scotland | £1,200–£1,700 | £2,500–£3,500 |

| Wales | £1,100–£1,600 | £2,400–£3,400 |

| Northern Ireland | £1,000–£1,500 | £2,300–£3,300 |

If you do plan to stay in the capital, look for a job that offers a salary above the average in London, which is £2,337 after taxes and insurance deductions.

Cost of Food in the United Kingdom

A single person usually spends about £419 a month on groceries. A family of four will need to allocate around a thousand pounds from their budget.

Prices for basic food items such as bread, eggs, and milk in supermarkets are set at a national level, so they are generally the same regardless of where you live.

A great way to save and enjoy delicious local food is to visit English outdoor markets weekly. Here, you can find bread, seasonal produce from farmers, coffee, and snacks priced from £1 to £16. You can also visit discount stores and compare the prices on the same products across different supermarkets.

| Item, kg/l/other | Price, £ |

|---|---|

| Meal at an inexpensive restaurant | 15 |

| Meal for two at a mid-range restaurant, 3 courses | 65 |

| Milk | 1.24 |

| White bread | 2.48 |

| Rice | 1.64 |

| Local cheese | 7.10 |

| Chicken eggs (dozen) | 2.96 |

| Chicken fillet | 6.63 |

| Beef | 10.50 |

| Oranges | 2.14 |

| Bananas | 1.18 |

| Potatoes | 1.17 |

| Tomatoes | 2.64 |

| Onions | 1.10 |

| Water | 1.11 |

Speaking of “indulgences”:

- A bottle of mid-range wine will cost around £8;

- Local beer costs about £2.04, while imported beer is £2.44;

- 20 Marlboro cigarettes cost £14.

Housing Prices in the United Kingdom

Rental or mortgage costs make up a significant portion of the family budget. The average rent in the private sector reached £906 in 2023. However, this figure is greatly inflated due to the high costs in some cities, so it would be more objective to look at the median values provided by gov.uk.

Average and Median Rental Prices in the United Kingdom, Monthly, £

|

| Private Renters | Social Renters | |

|---|---|---|---|

| Monthly | Median | 789 | 443 |

| Average | 954 | 484 | |

Social renters are local authorities and housing associations that provide rental housing.

Property insurance against fire, flooding, and theft starts from £10.

The location significantly influences rent prices, with the cheapest places to rent being in the North East, 40% cheaper than in the south of England.

| Region | Average Rent Price (£) |

|---|---|

| London | 1,480 |

| North East | 530 |

| Yorkshire and Humber | 550 |

| East Midlands | 561 |

| West Midlands | 602 |

| South West | 752 |

| North West | 623 |

| South East | 940 |

| East | 860 |

When planning to settle in the United Kingdom, you should also consider a rental deposit, which is typically at least 4 weeks' rent or one calendar month’s rent. Additionally, 45% of renters also pay various fees, including administration fees, holding fees, and agency finder fees. On average, the total fees range from £100 to £500 and upwards.

How much does it cost to buy a property in England? The average house price in 2024 is £285,000. Additionally, you would need to pay around £37,571 for valuation, deposit, and various fees. Foreigners have access to mortgages, with the interest rate depending on the duration of the visa or residence permit and the financial stability of the applicant.

Healthcare

Healthcare services in the United Kingdom are primarily provided by the National Health Service (NHS), which offers comprehensive care funded through taxation. Residents of the UK have access to free visits to general practitioners, inpatient treatment, and consultations with specialists. Depending on the region, prescription medications may be available either for free or at a reduced cost. There are also affordable options for dental and eye care.

The NHS provides mental health services and support for mothers and children. Additionally, private healthcare is available for those seeking to avoid waiting times in public clinics.

A foreign national can access the NHS for free if they:

- Apply for indefinite leave to remain;

- Are a health and care worker eligible for a work visa in this field;

- Apply to participate in the EU family reunification program;

- Are an asylum seeker;

- Obtain a visitor visa;

- Apply for a visa for six months or less from outside the UK.

Others must pay the immigration health surcharge (IHS) during the visa application process. The cost is £776 per year for students and £1,035 per year for everyone else. Even if a foreign national has private insurance, the IHS must still be paid. If a foreign citizen is denied indefinite leave to remain but granted limited leave, they must also pay the IHS.

How Much Money is Needed for Clothing?

According to the WRAP report from 2022, the average Briton spends £75.53 per month on clothing. Statista provides data on average weekly household spending on clothing for the same period, broken down by age, in pounds sterling:

- Under 30: £10.90

- Aged 39 to 49: £18.20

- Aged 50 to 64: £16.40

- Aged 65 to 74: £12.00

- Aged 75 and over: £6.80

On average, households spend about £14.40 a week on clothing.

Average prices for basic clothing items, according to Numbeo for 2024:

| Item | Price, £ |

|---|---|

| Pair of Levis jeans | 64.59 |

| Summer dress from a high street store | 32.24 |

| Pair of Nike running sneakers | 74.54 |

| Pair of men's leather dress shoes | 75.27 |

Generally, Britons do not tend to save on clothing. The WRAP report highlights a tendency for people to follow “fast fashion” trends and purchase more clothing than one could realistically wear. Most adults have an average of 12 t-shirts in their wardrobe, with 3 of them never being worn.

Utilities and Internet

A resident of a flat measuring 85 square meters will pay approximately £234.96 monthly for basic utilities, which include electricity, heating, water, and waste disposal.

The current electricity price in the UK is 24.5 pence per kWh plus a fixed daily charge of 60.99 pence. In 2025, the cost is projected to increase by 1.2%. Gas bills range from £60 to £120, depending on the size of the home.

Set price caps for gas and electricity per unit (January-March 2025), in pence:

| per kWh | Fixed Charge | |

|---|---|---|

| Electricity | 24.86 | 60.97 |

| Gas | 6.34 | 31.65 |

A single-person household pays an average of £30.50 per month for water. A couple living in the same flat will pay £42.90, while a family of four will incur a cost of £64.10.

The utility bills depend on the rates set by the supplier, the condition of plumbing and taps, the size of the household, and family habits. It is recommended to use energy-efficient and water-saving products to help reduce costs.

For mobile service, a plan including calls and 10 GB of internet will cost £12.62, while unlimited internet access at a speed of 60 Mbps will cost £30.93.

Leisure and Culture

The United Kingdom boasts a wide range of cultural attractions for its residents. On average, Britons spend approximately £65 a week on entertainment and cultural events.

Sports enthusiasts will spend around £33.51 per month on a gym membership for one adult. Britons love to play tennis and are willing to rent a court, with one hour on a weekend costing just £11.43. Some may prefer to catch a movie, with a single ticket costing £10.

Dining at a fast-food restaurant is also considered a form of entertainment. A combo meal at McDonald’s or a similar chain starts at £7.50. A can of cola costs £1.76, while those who enjoy sitting in a café with a cup of cappuccino will pay £3.32 just for the coffee.

Transport

The United Kingdom has an excellent public transportation network designed to make travel accessible for all residents. A single bus fare ranges from £2 to £5, while the price of a monthly pass is approximately £70.

A foreign national has the right to import and register their own vehicle in the UK. The steps to do this are as follows:

1. Complete an import declaration. This is usually handled by a transport company or customs agent, with fees paid by the foreign national.

2. Pay VAT and customs duty at the UK border. This is also the responsibility of the transport company or agent.

3. Notify HMRC (His Majesty’s Revenue and Customs) within 14 days of the vehicle’s arrival in the country.

4. Obtain confirmation that the vehicle meets safety and environmental standards.

5. Register the vehicle with the Driver and Vehicle Licensing Agency (DVLA) to receive a registration number and make local license plates. An update to the driving license may also be necessary.

6. Finally, obtain insurance.

How much does it cost to import a vehicle? Delivery costs range from £500 to £2,000. The UK customs duty is 10% of the vehicle’s cost, including delivery expenses. The VAT is 20% of the vehicle’s cost, including the price, delivery, and customs duty. The registration fee with the DVLA is £55.

The IVA test for compliance with safety standards costs between £150 and £450. Additionally, there may be extra expenses to bring the vehicle up to UK standards, such as modifying headlights, speedometers, etc. Insurance costs on average £957 per year for young drivers and £376 for drivers aged 50 and over.

The cost of petrol is £1.45 per liter.

Taxi and ride-sharing services set different prices in various cities. A typical fare in London averages £3 per mile.

Cycling is a great way to save on fuel and also offers health benefits. Bicycle clubs, accessible path schemes, and rental services are available in major cities. You can rent a bike for up to 24 hours, or pick one up at one station and drop it off at another for a nominal fee.

Electric scooters are also common: unlocking one costs £1, and usage is priced from 15 to 20 pence per minute, with daily and monthly passes available. To ride an electric scooter, whether rented or owned, you must hold a license, similar to that required for motorcycles. Riding on public roads is prohibited; scooters can only be used on roadways while adhering to traffic regulations. Violating these rules may result in losing your license (but only for riding the scooter).

Taxes

A non-resident of the United Kingdom typically pays tax only on income earned from employment within the country. The amount depends on the income tax brackets applicable at the time of filing the return, as well as any allowances or exemptions that may prevent double taxation with the home country.

If an individual works entirely outside the United Kingdom or earns income from overseas investments, those earnings are generally not subject to tax.

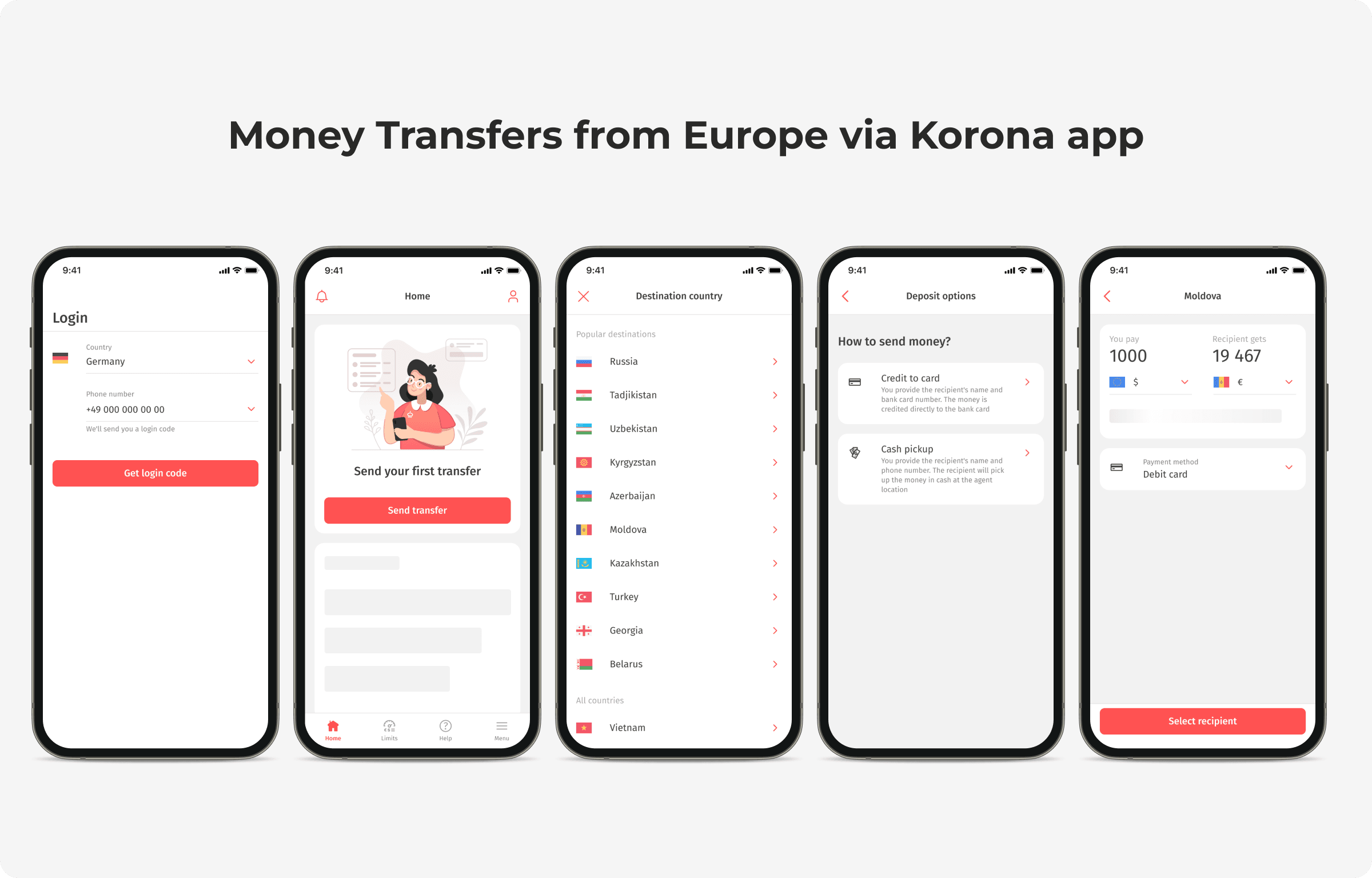

Money Transfers from the United Kingdom

Is it expensive to live in the UK? Definitely, it can be somewhat more expensive compared to other European countries, especially if you stay in London. However, with careful financial planning, it’s possible to enjoy a comfortable lifestyle while also supporting loved ones back home. An easy way to send gifts is through the Korona app.

The advantages of the app extend beyond fast transfer speeds, low surcharges, and no fees. Users appreciate its convenience and intuitive interface, as well as the responsive customer support. You may be interested in the currency conversion rate from Pounds to Lira when transferring

The app is available on the App Store and Google Play.

In our blog, we share extensive insights about living and working in Europe. Follow the link if you want to learn more.