Taxes in Germany: Legal Specifics

When migrants move to Germany, it can be challenging to understand the local rules regarding tax payments. The situation is complicated by the language barrier. In this article, we will discuss which taxes foreign citizens need to pay in Germany, what tax deductions are available, and how to pay taxes in Germany.

Specifics of the Tax System in Germany

When a migrant arrives in Germany, one of the first tasks is to obtain a tax identification number. There are two numbers specifically for foreigners: Steuer ID and Steuernummer. The first number, Steuer ID (or Steuer Identifikationsnummer), is the primary one; it is important to remember this name as it corresponds to what is known as the Tax Identification Number (TIN) in Germany. This number is assigned upon the first registration in Germany and is issued only once. The second number, Steuernummer, is given by the tax office when a foreigner registers in a new city. If a move happens, a new Steuernummer must be obtained at the new place of residence. If a migrant starts working without an identification number, there won’t be any penalties; however, by default, the employee will be assigned to tax class 6, which means the highest tax rate will be deducted from their salary.

All taxpayers in Germany are divided into six classes. The class you are assigned to depends on your marital status, the presence of children, and the amount of income:

| Tax Class | Characteristics of the Taxpayer |

|---|---|

| 1 | Single, widowed, or divorced |

| 2 | Single parent |

| 3 | Married (officially or in a civil union) with a higher income than the partner |

| 4 | Married with the same income as the partner |

| 5 | Married with a lower income than the partner |

| 6 | Works multiple jobs |

Each tax class has its own limits on the tax-free allowance. This means that the government sets a minimum income threshold below which no tax is withheld. Taxes are only paid on the amount that exceeds this limit. If necessary, the tax class can be changed upon request (even retroactively). If at the end of the tax period, a taxpayer realizes that they would have benefited more from being in a different tax class, they can simply submit a request, and the government will recalculate their taxes. Any excess amount that has been overpaid will be refunded to the applicant.

Types of Taxes in Germany

All working Germans and migrants are required to pay income tax (Einkommensteuer) in Germany. The following types of income are subject to taxation:

- Income from self-employment and business activities

- Official salaries

- Inheritance and alimony

- Rental income from leasing properties

- Income related to agriculture (for example, sales of farm products)

- Income from real estate transactions

Here are the types of income that are exempt from taxation:

- Unemployment benefits

- Social benefits from the government

- Parental allowances and child benefits

- Lottery winnings

It is important to note that while social benefits are not taxable, they may still be considered when calculating the total taxable income.

The German Tax Code provides for a progressive income tax system. This means that each portion of income is subject to its own tax rate. There is a specific income tax table that can be used to determine the applicable tax rate in different circumstances. In some cases, the income tax rate in Germany can be as high as 45%.

In addition to income tax, taxpayers also pay a solidarity surcharge (Solidaritätzuschlag) and church tax (Kirchensteuer). The solidarity surcharge is an additional levy intended to finance the former East Germany. Since 2021, this surcharge is only paid by individuals whose income exceeds a certain amount (which may change at the discretion of the authorities).

The church tax is used to fund churches. When obtaining a tax number, you must indicate your religious affiliation on the application form. Contributions will be directed to that church, and the surcharge amounts to 8-9% of the primary tax. Individuals can opt out of paying church tax by submitting a request to the registry office or court for “leaving the church.” A one-time administrative fee must be paid, but afterward, you will be exempt from this charge.

Additional Taxes in Germany:

- Broadcasting fees

- Pet tax

- Vehicle tax

Not only taxes are withheld from salaries but also social contributions, which include health insurance, pension insurance, unemployment insurance, and disability insurance. The amount of contributions depends on the salary, but the government has set limits. Once a worker’s income reaches a certain threshold, the contribution amount stops increasing and is charged at a fixed rate.

Tax Deductions

Despite the complex taxation system in Germany and high tax rates, every citizen and migrant has the right to a refund on a portion of the taxes paid. Every year, by July 31, German citizens and migrants must submit their tax returns. The declaration is submitted electronically. To complete the form, individuals can either seek help from a paid service provider or use the free tool ELSTER, developed by the German Ministry of Finance.

Although certain categories of citizens are exempt from the mandatory filing of a tax return, most people still choose to do so. This is because the tax return includes all categories of expenses for which tax deductions may be claimed. In other words, the government refunds part of the taxes paid into the budget. Expenses eligible for tax deductions include:

- Work-Related Expenses. If you are looking for a job and regularly send resumes to potential employers, the government is ready to reimburse costs for each application submitted. Travel expenses to the location where interviews are held are also compensated. You can get refunds for the purchase of work uniforms, shoes, and literature acquired for work purposes. The government even compensates travel expenses to work, regardless of the mode of transportation used (a specific amount is refunded for each kilometer traveled). If you have to spend money on meals, there are also deductions available for those expenses.

- Family-Related Expenses. When a taxpayer has to move to a new residence, the government is willing to cover some of the costs associated with hiring transportation and movers. The key is to pay for all services officially and keep receipts. If a migrant moves to the country with young children, they will likely enroll them in daycare or hire a nanny. The tax deduction allows for a portion of the money spent on nannies, daycare centers, and schools to be refunded.

- Educational Expenses. If you attend paid language courses to improve your German language skills, those expenses can be included in your tax return for a refund of part of the money spent. Most foreign nationals opt for this route to learn to communicate in German more quickly. Of course, in the beginning, you can use apps available on smartphones, but for normal life, learning the language will be necessary in any case.

If you pay taxes in Germany, it is important to keep all receipts and invoices. When filing your tax return, you can get a refund on a substantial portion of the taxes you paid. The key is to attach a statement from your employer to your declaration, which specifies the amount of taxes withheld.

Migrants who have moved to Germany will find information on more than just taxes useful. There are a number of resources available that can help newcomers adapt to the country more quickly and learn the language. Some of these resources offer support in case of difficult life situations.

How to Pay Taxes in Germany

The payment scheme depends on the type of taxes. For individuals in Germany, the main taxes and social contributions are automatically withheld by the employer from the salary. At the end of the year, employees receive a statement detailing their income for the period and the percentage of that income that was withheld for taxes.

Some taxes, however, must be paid independently based on invoices, such as those for broadcasting fees or the pet tax, for example.

Conclusion

Both citizens and migrants pay taxes in Germany. To avoid overpaying on mandatory contributions, it is essential to obtain a taxpayer identification number as soon as you arrive in the country; otherwise, taxes will be levied at the highest rate. The taxation system in Germany is quite complex, with various classes of taxpayers and tax amounts that depend not only on salary levels but also on marital status, the presence of children, and other factors. Nonetheless, part of the taxes paid can be refunded through tax deductions.

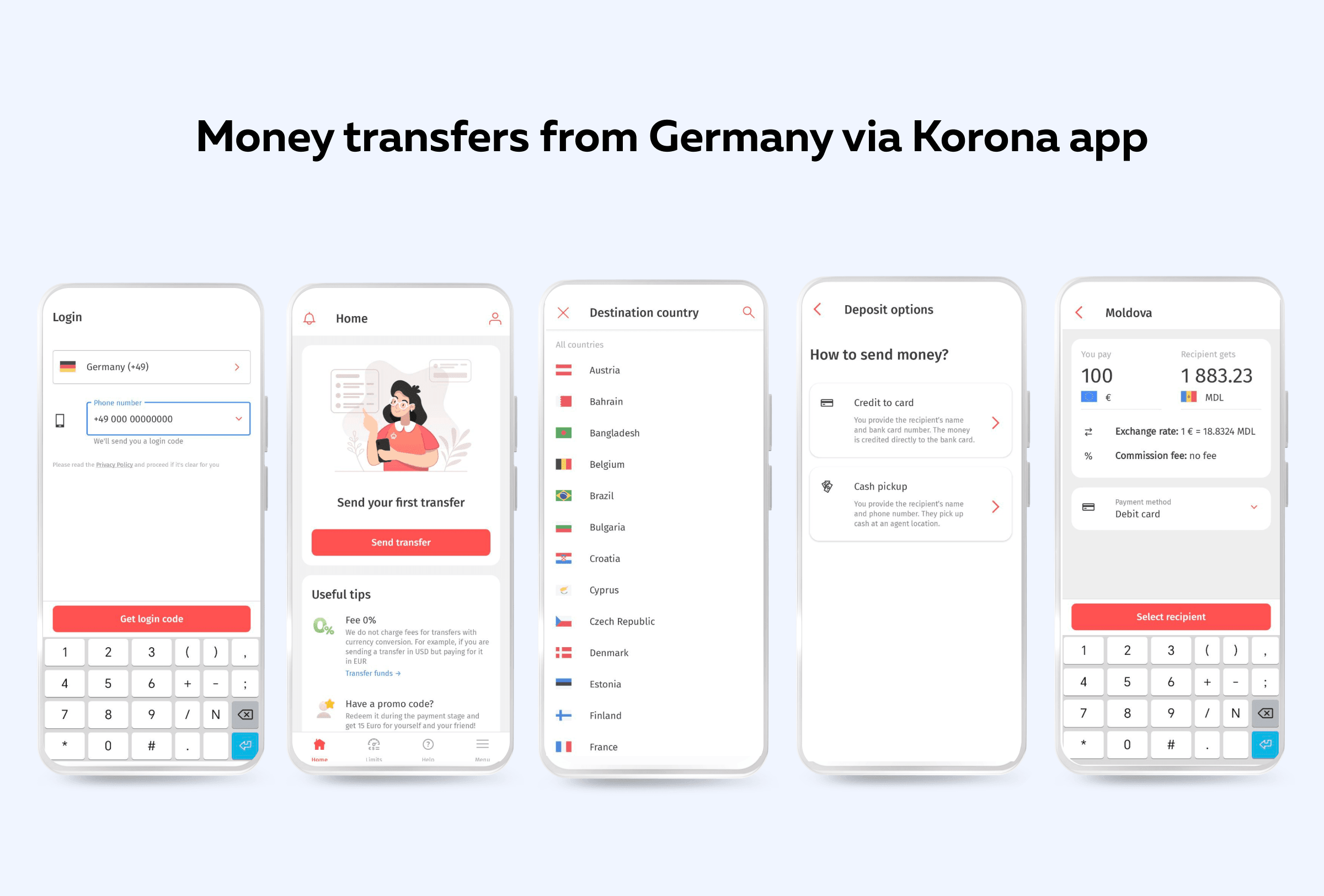

Additional savings on expenses can be achieved through promotions, discounts, and special offers. For example, if you regularly send money abroad from Germany, be sure to use services with the lowest fees. The Korona app allows you to send money from Europe while charging minimal transaction fees, and in cases where the sending and receiving currencies differ, no fees are applied to the sender at all.

If you are interested in topics related to life in Europe, be sure to check out other articles on our blog.