How to transfer money to Nepal from European countries

Workers from Nepal are expanding the geography of their employment. In addition to Middle Eastern countries (Saudi Arabia, Kuwait, Qatar, Bahrain, UAE, Jordan) and Asia (Malaysia, South Korea), they are more oftenly looking for work in Europe.

After receiving an official permission from the Nepal authorities to work in the EU, tens and hundreds of thousands of Nepalis come to Europe in search of work. Moreover, an increasing number of Nepali plan not to return to their homeland, but to settle down and start a new life here.

Nevertheless, they still send a large portion of their earnings back to Nepal, while they also begin to save some money for settling in a European country.

In this article, we will discuss various ways to send money to Nepal, as well as compare several money transfer systems with the Korona mobile application.

Previously, we wrote about employment for Nepalese workers in Europe.

Many migrants in Nepal use cash transfer services such as Western Union, MoneyGram, and others to send money from abroad, as opening a bank account requires a 100% legal status, which not everyone has.

On the other hand, such money transfer companies apply high fees to their cash sending and receiving services. If a person sends transfers on a regular basis, this may add up to a significant amount.

Nowadays, online money transfer services offer the most favorable options and fees. The following types of transfers are supported:

- from card to card,

- from card to cash withdrawal,

- from bank account to card,

- from bank account to account,

- from bank account to cash.

The only drawback is the requirement to have a bank account. However, if you are working legally in Europe, you’ll have no trouble opening a basic bank account.

Next, we will try to compare the conditions for money transfers to Nepal from several European countries so that you can choose the most advantageous payment system.

Remittance services to Nepal from Poland: condition comparison*

| Service | Sending | Duration | Fee | Currencies | Receiving |

|---|---|---|---|---|---|

| Korona | debit/credit card | several minutes | 0.95 € | PLN-USD, EUR-USD | cash |

| Instarem | debit card | same day | 2.29 € | EUR-USD | to a bank account |

| Western Union | debit/credit card | several minutes to 4 days | 4.90-9.90 zł | PLN-NPR | cash, to a bank account |

| Paysend | debit/credit card | up to two days | 4.90 zł / 1.5 € | PLN-NPR, EUR-NPR | to a bank account, to a card |

| Wise | bank account | 1-3 days | 15.09 zł (16.69 zł (external fees 86.96 zł) | PLN-NPR, PLN-USD | to a bank account |

| Remitly | debit/credit card/bank account | during the day | 9.00 zł | PLN-NPR | cash, to a bank account |

| WorldRemit | debit/credit card | several minutes | 24.00 zł | PLN-NPR | cash, to a bank account |

*The commission fee and other conditions are valid for transfers of 400 Polish zloty (as of March 22, 2023). The information used to compile the table was obtained from aggregator websites and the payment system resources themselves.

As can be seen, only one of the above services offers to transfer money to Nepal with minimal fee. It’s the Korona mobile app. This service operates in more than 50 countries in Europe and Asia, with over 18 million users having already downloaded the app.

Later in the article, we will provide more details about this service, but for now, let’s compare the conditions for sending money from a country where the national currency is the euro to Nepal.

Remittance services to Nepal from Portugal: condition comparison*

| Service | Sending | Duration | Fee | Currencies | Receiving |

|---|---|---|---|---|---|

| Korona | debit/credit card | several minutes | 0.95 € | EUR-USD | cash |

| Instarem | debit card | same day | 2.19-5.98 € | EUR-NPR, EUR-USD | to a bank account |

| Western Union | debit/credit card/bank account | several minutes to 4 days | 1.90 € | EUR-NPR | cash, to a bank account |

| Paysend | debit/credit card | several minutes to 2 days | up to 1.5 € | EUR-NPR | to a bank account, to a card |

| Wise | bank account | 1-3 days | 3.40-3.63 € (external fees 18,54 €) | EUR-NPR, EUR-USD | to a bank account |

| Remitly | debit/credit card | within one day | 4.99 € | PLN-NPR | cash |

| WorldRemit | debit/credit card | up to 24 hours | 5.99 € | EUR-NPR | cash, to a bank account |

*Commission fees and other conditions are valid for transfers of 100 euros (as of March 22, 2023). The information used to compile the table comes from aggregator websites and the payment system resources themselves.

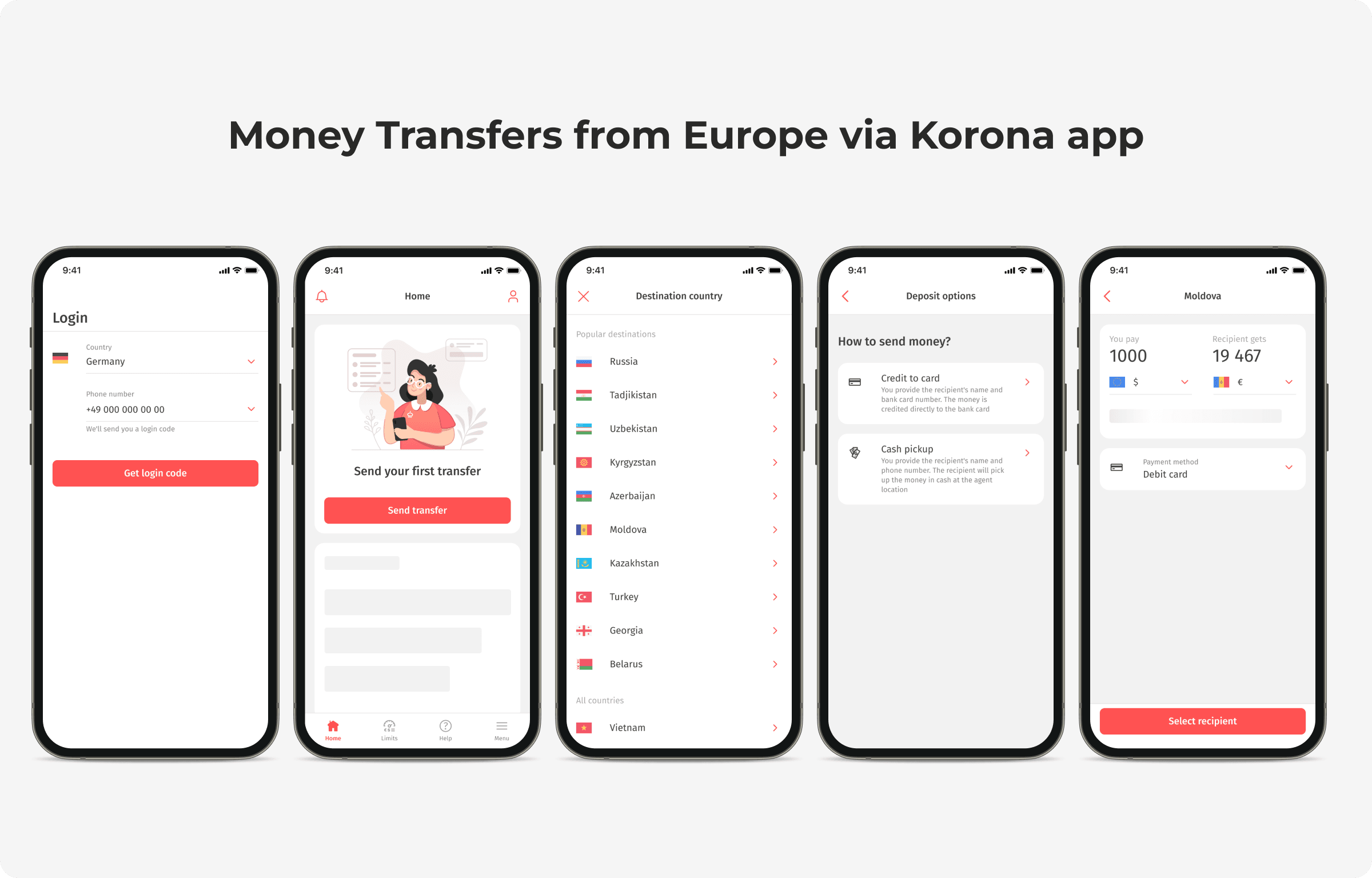

How to transfer money to Nepal using the Korona app

The mobile app Korona allows sending money transfers to Nepal, and the limits allow transferring quite large amounts.

- 1000 euros within 3 months without identity confirmation;

- 1000-10,000 euros within 6 months — provide a photo of passport/ID and a selfie;

- 10,000-15,000 euros within 6 months — provide receipts for payment of utilities, home phone, internet, etc.;

- 15,000 euros and more — provide an employment agreement or other document confirming sufficient income.

Documents can be uploaded directly into the application. Second level confirmation usually takes no more than a couple of hours.

KoronaPay transfers can be paid in euros or the national currency of the sending country (Polish zloty, Czech crown, Serbian dinar, etc.), and the recipient receives payment in US dollars.

Payment for the transfer can be made depending on the sending country in the following ways:

- Debit card

- Credit card

- Bank account.

Money can be sent from any European bank card, except for Poland, Bulgaria, and Romania. In these countries, money transfers to Nepal can only be paid for with cards issued by local banks.

Try sending a money transfer using the Korona mobile app. It is not difficult, very convenient, and most importantly, cost-effective. You can check the transfer conditions without entering personal information.

Instructions for sending a transfer:

After the payment, a transfer code/number will be generated, which must be passed on to the recipient. The money will be delivered instantly.

In our blog, we are not only talking about money transfers to Nepal, but also discuss how migrants from different countries live and work in Europe. See all topics here.

The information on rates and fees for money transfers is valid as of the publication date.

4/11/2023