Online Transfers Abroad: Myths and Reality

From telegraph money orders to interbank SWIFT transfers, this is the journey that money transfers have taken over the past century. The digital era has offered users online transactions, allowing money to be electronically sent from a computer or phone to practically anywhere in the world within minutes.

However, these newfound opportunities have raised many fears and doubts regarding the security and confidentiality of such transfers.

In this article, we’ll debunk the main myths and fears about online money transfers. Earlier we wrote about useful applications for life in Europe.

Myth 1: Online Transfers Are Unsafe

As soon as digital money transfers became recognized as an inevitable reality of financial relationships, banks, national regulatory authorities, and security structures began seriously considering how to protect these transactions from fraudsters on one hand and prevent money from being used for illegal activities on the other.

As a result, banks and other financial institutions developed security protocols that defined the rules and procedures for digital money transfers.

To ensure the integrity and confidentiality of online payments, encryption technologies, multi-factor authentication, and secure networks have been implemented.

In 2005, the Council of Europe adopted a Convention aimed at preventing the financing of criminal activities and corruption, which was subsequently ratified by national governments.

All these measures contribute to sufficient security for online money transfers when users adhere to recommended security measures. For example, not disclosing the CVV code of a bank card to anyone.

How Security is Ensured in Korona App Transfers

Licensing

KoronaPay service holds a European license for conducting electronic money transfers and complies with all requirements for protecting users' confidential data.

One-Time Password (OTP) Entry

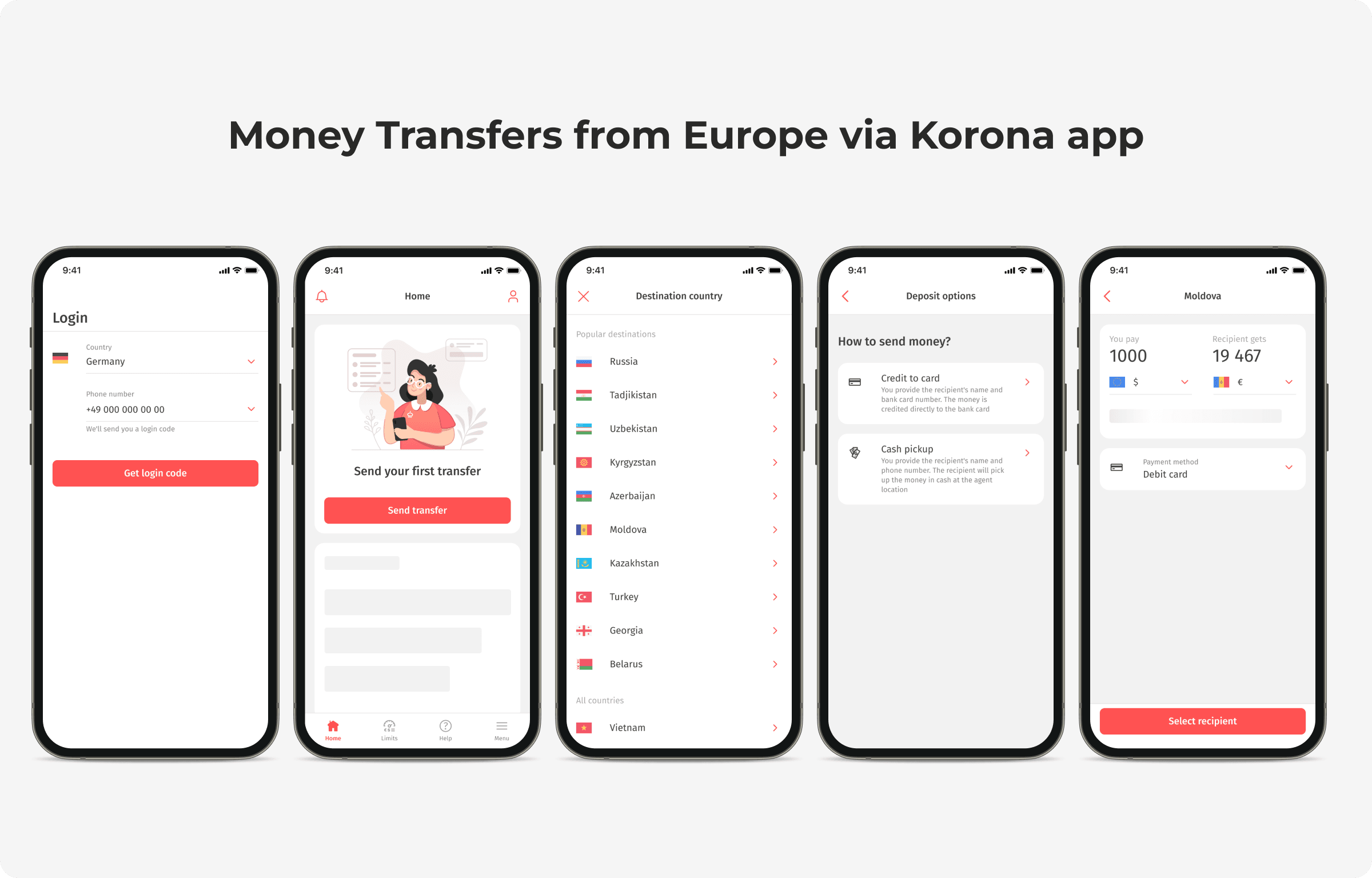

Each time you log into the Korona app, you’re prompted for a code sent via SMS.

Two-Factor Authentication

KoronaPay service supports security protocols used by payment systems like Visa and Mastercard, including the 3-D Secure protocol.

In the Korona app, transfers cannot be made from a bank card that doesn’t support this protocol. In practice, this means that during money withdrawal, users must confirm the transaction via a code from the bank or within the bank’s app.

Limits

Within the framework of anti-money laundering laws, limits are set on the amounts of money that can be sent. Documents required to increase the transfer limit are verified by the service’s own AML department.

For user convenience, Korona app implements a clear and transparent scheme for increasing limits, which works efficiently despite the restrictive measures. Necessary documents can be photographed and uploaded directly within the app, and the verification process usually takes only a few minutes.

Myth 2: Money Transfers Are Taxed

No, this is not the case. Transfers between individuals, if not for the sale of goods or payment for services, are not subject to taxes. This also applies to online transfers abroad.

Banks typically do not even report the receipt of such funds to tax authorities, except in cases of suspected law violations.

If money transfer is proven to be from commercial or taxable activities, a tax on the transfer may be levied. However, it’s important to reiterate: this doesn’t apply to private transfers.

Myth 3: Sending Money Online is Expensive

This myth was a reality several decades ago when there were few money transfer services, yet demand for the service was significant.

Today, there are at least two dozen such systems operating solely in Europe. Admittedly, not all of them facilitate transfers beyond the European Union, and some routes may be relatively rare. However, overall, this service is now more than accessible.

Most services typically charge a commission and profit from exchange rate mark-ups on international transactions. However, considering the accessibility of the service, the amounts involved are generally modest.

However, when it comes to regular transfers, the cumulative costs of using a payment service can be significant. Therefore, the Korona app has gone further: it has waived the commission for currency conversion, which applies to most international transfers. A commission of 0.9% of the amount is only charged for euro-euro transactions, where there is no exchange rate markup. In other words, Korona does not charge you twice.

Myth 4: Opening an Account is Required for Money Transfers

Dispelling this myth, it’s worth noting that sending money online implies that the user already has a bank account, a debit or credit card from which the money is debited.

However, certain providers offer (and some even require) opening an account for money transfers within their own system, implying some additional services for the client.

The Korona app doesn’t burden users with such obligations and offers fast and simple money transfers with instant delivery. In the app, users can send money from a debit/credit card or a bank account.

Receiving funds is available immediately on the recipient’s card or in cash at pick-up points in the recipient’s country.

Myth 5: A Bunch of Documents Will Be Required

Undoubtedly, when sending large amounts, some documents may be required, but we’re certainly not talking about piles of paperwork. Typically, documents verifying identity, as well as confirming residence and income, are requested to comply with the requirements of European regulatory authorities (see Myth 1). And this rule cannot be bypassed.

However, some services require filling out a registration form with personal data and entering card/account details right from the first contact with the user.

Korona does not request any data until the actual sending of the money transfer. By authorizing via phone number, users can explore the app, calculate the amount, learn all the conditions, and only then fill in their details. For sending up to a total of €1,000 within 3 months, no documents are required*. Further conditions apply for increasing limits.

We have explained and demonstrated that sending money online is safe and quite inexpensive. And using mobile apps allows this process to become an almost invisible part of our lives. A money transfer can be sent between paying for a couple of cups of coffee, which is an undeniable advantage.

In our blog, we write about life and work in Europe. You can see the topics of all articles here.

*For some destinations, proof of identity is required at the first transfer, regardless of the amount.